San Jose Water Company’s latest pitch to raise rates comes before state regulators this week, and irate customers are gearing up for a showdown.

The investor-owned utility, which overbilled ratepayers by at least $1.8 million last year, asked the California Public Utilities Commission (CPUC) to let it boost returns on infrastructure investment from 9.43 percent to 10.75 percent. But Administrative Law Court Judge Karl Bemesderfer weighed that request against testimony from ratepayer advocates and, in a Feb. 6 ruling, deemed 8.3 percent a more reasonable rate.

Then, as one observer put it, all hell broke loose.

Lobbyists and lawyers repping San Jose Water Co. and three other investor-owned water utilities flocked to Sacramento in an effort to sway the five-member CPUC in a series of private ex parte meetings.

Meanwhile, industry groups—the Silicon Valley Organization and Santa Clara and San Benito Counties Building and Construction Trades Council among them—bombarded commissioners with strongly worded missives denouncing the judge’s decision.

In a March 9 letter, California Water Association Executive Director John Hawks blasted Bemesderfer’s proposal to deny the water companies’ sought-after rate increase as “unjust,” “fraught with errors” and “obvious misstatement of facts.” He accused the CPUC of bowing to political pressure from “the legislature, the media and certain activist groups dominated by affluent and high-volume water users.”

The scolding apparently paid off.

Commissioners agreed to let the water companies plead their case once again in an 80-minute hearing that took place last week in Sacramento. Grassroots activists said the March 15 hearing made a mockery of due process by continuing proceedings even after a judge rendered his decision.

“There appears to be a double standard,” said Saratoga resident Rita Benton, who co-founded an industry watchdog group called Water Rate Advocates for Transparency, Equity and Sustainability (WRATES). “It’s OK if the water monopolies and their lobbyists influence the commission, but it’s not OK if the ratepayers speak out. The private water utilities are saying the administrative law judges should not be trusted to do their job.”

Come Thursday, the CPUC will vote whether to hew to the industry’s demands, which would generate an additional $7.6 million in revenue for San Jose Water Co. this year, or abide by the judge’s ruling. The meeting will be livestreamed here.

The rate increase being considered this week comes as San Jose Water also petitions for a general rate hike. In a case that will take a year of review to finalize, the South Bay utility is asking the CPUC to let it up customers’ water bills by 18.6 percent through 2021 for a revenue bump of $69.1 million.

Water bills are surging nationwide as utilities try to fix aging pipes, but at nowhere near the pace of San Jose Water Co.

The South Bay utility has already upped its rates by 73 percent for the typical customer since 2014, according to a WRATES analysis. That’s an increase of more than 20 percent a year—far higher than the national average of 5.5 percent, which according to the U.S. Department of Labor is itself is three times the rate of inflation.

Meanwhile, the company is expanding its reach. San Jose Water’s parent corporation, SJW Group, announced last week that it plans to merge with Connecticut Water Service in a deal that would make it the third-largest investor-owned water utility in the U.S. That would give it an equity value of $1.9 billion and a customer base of 1.5 million in California, Maine, Connecticut and Texas, according to news reports.

The $750 million merger, which is pending regulatory approval, is also expected to boost dividends, according to an SJW Group announcement that predicted “mid- to high-single digit accretion in earnings per share over the next couple of years.” That’s more good news for investors and in line with a longstanding trend for the multi-state corporation. SJW Group is part of a rare breed of companies called “dividend kings,” so named for surpassing 50 consecutive years of payout growth.

SJW Group’s new CEO Eric Thornburg, who makes a $750,000 annual base salary, told the Mercury News that the tie-up would strengthen the company’s financial standing even further and would reduce capital costs, making it easier to upgrade old facilities.

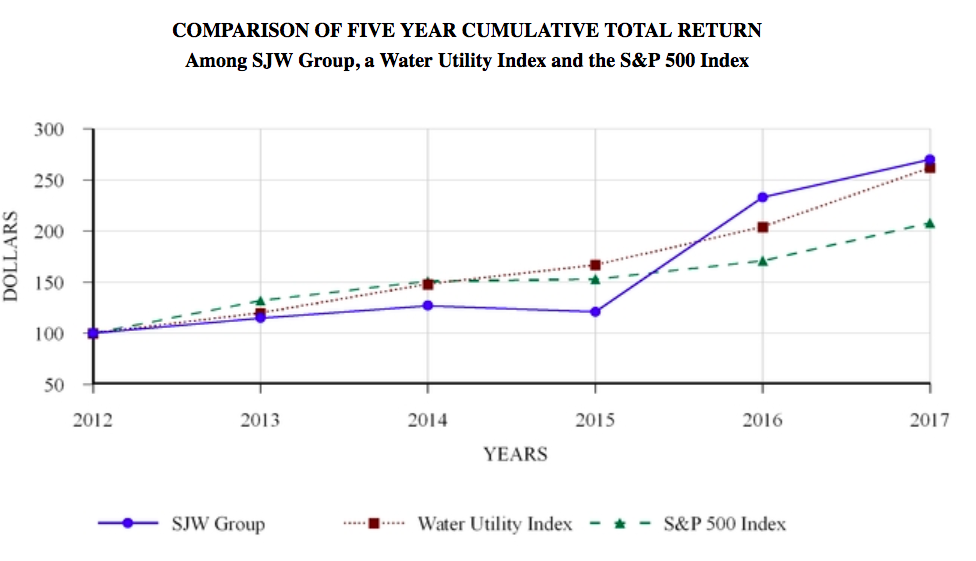

Source: U.S. Securities and Exchange Commission

The industry has been able to enjoy such positive outlooks because of a favorable regulatory climate, according to the Office of Ratepayer Advocates (ORA), the CPUC’s independent consumer protection arm. It also stands to gain from recent federal tax cuts that slashed the corporate tax rate from 35 to 21 percent, as SJW Group noted in a recent U.S. Securities and Exchange Commission filing,

Judge Bemesderfer underscored the ORA’s argument in his February ruling, saying that, “risk-hedging and risk-spreading mechanisms adopted by [the CPUC] over the years have effectively guaranteed that the applicants will earn their allowed returns on rate base, making investment in their common equity nearly risk free and their [returns on equity] should be adjusted downward to reflect this fact.”

In pleading for higher returns on equity, however, SJW Group subsidiary San Jose Water Co. plays another tune. And the California Water Association argued that point on its behalf in its letter of protest, calling the ORA’s assertion “ridiculous” and claiming that the state’s regulatory environment makes investment in the industry fraught with risk.

“No state has the severe combination of water supply, water quality and operational risks that utilities experience in California,” Hawks wrote in the letter. “This fact should be paramount when considering company-specific risk factors.”

Benton—whose group WRATES recently teamed up with its SoCal-based counterpart, the Coalition for CPUC Water Rates Reform—said regulators should put consumer protections ahead of industry interests.

Otherwise, she said, they can expect a “consumer rebellion” over assiduous rate hikes.

Thank you Rita, Mary and WRATES for bringing these very important issues to the public’s, media’s and hopefully elected official’s attention. Towns and Cities serviced by San Jose Water should consider taking over San Jose Water. I don’t see the benefit of a merger for San Jose Water customers; it will only lead to more financial confusion and more difficulties for CPUC to financially regulate San Jose Water, especially regarding rate increases. Will San Jose Water’s affluent customer base end up paying for improvements in areas serviced by CONN Water.

Was your use of the word “serviced” intended, or do you just not know the difference between served and serviced?

The increases of nearly 20% per year by SJWC outstrip the wage increases of even the best earning family incomes and are even worse for those on fixed incomes!

They’re raising the rates and you can’t drink the water out of the tap as it tastes awful. Former San Franciscan where the water is pristine.

When they put in rent control, landlords said water cost grow much faster than inflation. The housing department laughed us off, insisting there is no evidence. Many people don’t know about water hikes because 45% of you rent and you are blocked from the increases.

I’m flabbergasted by the actions of the SJW robber barons. I’ve noted in past postings that I know of three people living here in San Jose residential neighborhoods who have drilled wells in their backyards. They don’t drink the water but they use the well water for a number of other things. Screw SJW!!! The water table is high and I think more and people are going to do this.

Why do we allow public utilities to be investor owned?

Dear PUC President Picker and Commissioners,

I am a customer of San Jose Water Company (SJWC) and I am very frustrated with the blatant gouging that San Jose Water has resorted to, increasing their income to $59M compared to a $22M from prior years. We are so frustrated we currently have a petition that over 2600 have signed here that is asking for a municipal utility company to serve us instead of SJWC.

Administrative Law Judge Bemesderfer’s ruling of February 21, 2018, in A.17-04-001 proposed a rate of return of 8.3% instead of SJWC’s request for 10.75%. I understand SJWC lawyers have been persistent and pushing back on Judge Bemesderfer’s ruling. Enough is enough!

In your meeting on Thursday March 22nd, Agenda Item 42, please DO NOT listen to the greedy voices of the lobbyists and the SJWC lawyers. SJWC profits continue to go up on the backs of citizens like me. SJWC has gotten used to the annual bounty and that needs to stop. Please uphold a good man Judge Bemesderfer’s ruling and keep the Rate of Return of 8.3%.

Here is a summary of SJWC’s revenue and income story

o Revenue increase (2010 to 2017): 91% INCREASE

o Income (before Tax) increase (2010 to 2017): 220% INCREASE

o Income increase (2010 to 2017): 248% INCREASE

I implore you to do the right right, and represent the people of California, and push back against the greedy tactics

There is one point we are all missing in this discussion. Supply chain. San Jose water company buys its water from a monopoly. That monopoly is the santa clara valley water district. San Jose water company cannot buy its water and sell it for less than what they paid for it. Water district has had water rates increases for the past 20 years, with may be a couple of years of freeze. Those rate increases are passed on to you and I as rate payers. In public utility arena, the water company is by law prohibited from using money from one rate payer base to subsidize another community across the country. The key to this madness with rate increase lies with water district. If they sell water for less, that savings will trickle down to us poor people in san jose from the san jose water company. Call water district board of directors at 408-265-2600 and ask them to freeze the rates that shows ten-year projection of 10 per cent increase or more per year.