After 26 virtually unopposed years, Santa Clara County Assessor Larry Stone may finally have met a match in Gary Kremen.

Read More 13San Jose Inside (https://www.sanjoseinside.com)

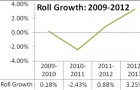

Almost half a million assessment notices went out to Santa Clara County property owners today, and following three years of minimal or negative growth in assessed property values, the county reports its first solid increase since 2008. Overall, total net assessed value of all real business and personal property values increased by 3.25 percent to $308.8 billion.

Read More 21It is pretty common to hear from residents, when discussing our City budget: “But i pay my property taxes.” As I have covered before on a prior blog post, your property tax bill does not flow 100 percent to the City. Much of it is taken by the school districts, County, community colleges and special districts. (This does not include various parcel taxes, school bonds, hospital bonds, that are collected via your property tax bill.) Even with all these other government entities taking nearly 90 percent of your property tax, this remaining portion is the number-one source of revenue, by a large measure, for the City of San Jose.

Read More 44